tax on unrealized gains yellen

When the income tax first went into effect in 1915 the top rate was a mere 7 and fell only on those making 500000 a year or more. Speaking to CNN on Sunday the former Federal Reserve chair said the measures would target liquid assets held by extremely wealthy individuals.

Nancy Pelosi Says A Wealth Tax On Billionaires Unrealized Gains Is On The Way Mish Talk Global Economic Trend Analysis

An unrealized gain is when something you own gains value but you dont sell it like your house or your retirement fund.

. Cryptocurrency is not looked at by the IRS as currency but rather as property. Instead of paying taxes when you finally sell your home or cash out your 401k or trade stock you would be taxed on the subjective made-up unrealized value gain right now. Treasury Secretary Yellen proposes a tax on unrealized capital gains to finance Bidens Build Back Better plans.

Lawmakers are considering taxing unrealized capital gains. President Biden Unveils Unrealized Capital Gains Tax for Billionaires. The Wyden plan by contrast would tax only the unrealized gain a billionaire family had but the long-term capital gains rate is 20 percent.

The plan will be included in the Democrats US 2 trillion reconciliation bill. WASHINGTONA new annual tax on billionaires unrealized capital gains is. The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US.

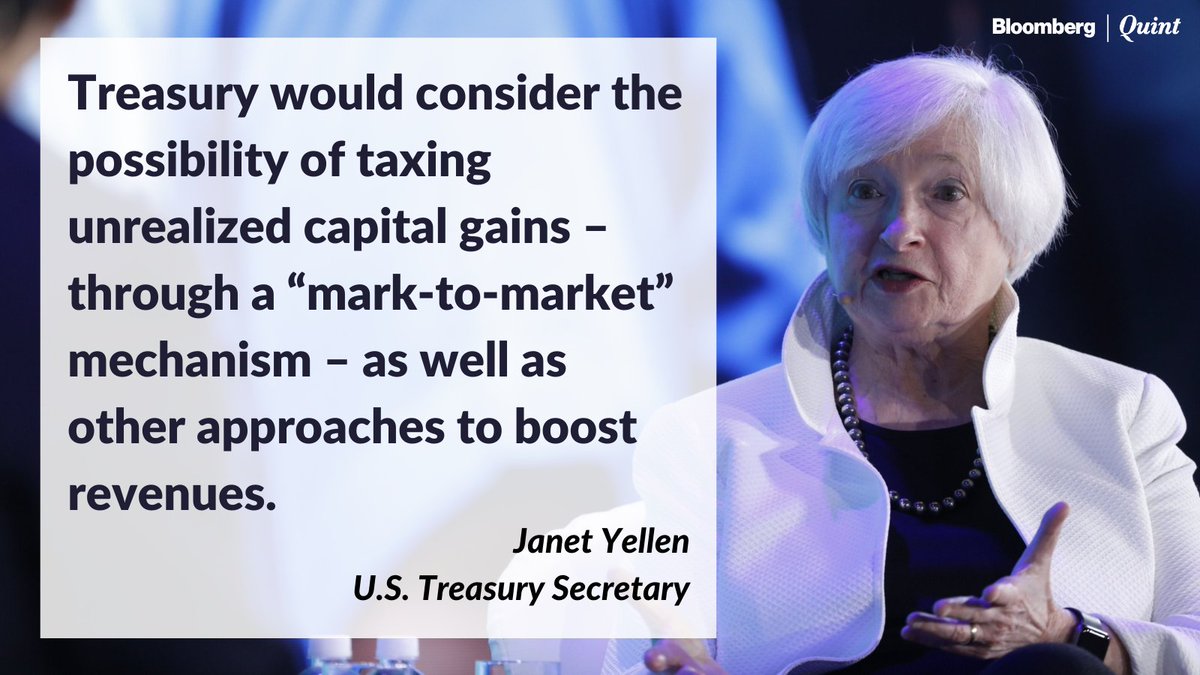

If Yellen and the US. Democrats have proposed partly funding some of their multitrillion-dollar spending plan with a tax on the unrealized capital gains of anyone who makes more than 100 million per. Yellen had first proposed the tax on unrealised capital gains in February 2021.

WEALTH CAPITAL GAINS TAXES. Is exploring plans to tax unrealized capital gains sparking fierce criticism on Crypto Twitter. Disclosetv disclosetv October 24 2021.

Yellen argued that capital gains are an extraordinarily large part of the. A Texas resident would see the following taxes. Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold.

Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US. Their last fiscal resort is taxing unrealized capital gains of billionaires Journal Editorial Report. Government coffers during a virtual conference hosted by The New York Times.

Congress have their way wealthy investors may be taxed on those unrealized gains the price appreciation of their assets. NEW US. Taxing unrealized capital gains also known as mark-to-market taxation What is an unrealized capital gain.

Federal long term capital gain rate 396 BidenYellen proposal v 20 today. California long term capital gain rate 133. Capital gains tax is a tax on the profit that investors realize on the sale.

0000 0138. Treasury Secretary Janet Yellen is currently considering some shocking policies. Since then many wealth managers from Howard Marks to Peter Mallouk as well as many others have argued that this.

Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds. Ron Wyden D-Oregon would impose an annual. Yellen said Biden has not proposed a specific wealth tax but would tax the investment income of families making more than 1 million at the same rate they pay on.

Yellen made the remarks in response to a question from Tapper about whether a wealth tax should be part of how Democrats look to pay for Bidens 35 trillion. To address liquidity concerns illiquid taxpayers could elect to defer paying the minimum tax on unrealized gains from non-tradeable assets until they were realized subject to. This article is in your queue.

For assets with modest returns the math of. Yellen said lawmakers are considering a billionaires tax to help pay for Bidens social safety net and climate change bill. Total long term capital gain rate 567.

National Investment Income Tax 38. That sounds good until you realize that 100000 increase was an unrealized gain. BeInCrypto The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains.

It goes against the concept of taxing income because thats a tax on generated cash flow whereas there is no generated cashflow in. Treasury Secretary Janet Yellen told CNNs Jake Tapper on Sunday that Senate Democrats are considering a proposal to impose a tax on unrealized capital gains of the wealthiest Americans. The tax would apply to all property which includes stocks real estate gold and even cryptocurrencies like bitcoin.

And if you dont pony up for Janet Yellens salary the government is coming for you. The president of the Finance Committee of the Senate Ron Wyden showed his support for the tax on unrealized capital gains. Bidens newly appointed US.

The weeks best and worst from Kim. Treasury Secretary Janet Yellen explained on CNN Sunday that the proposal raised by Sen. Treasury Secretary Janet Yellen has revealed that the US.

Federal long term capital gain rate 396 BidenYellen proposal v 20 today. EFE The tax could potentially impose large tax burdens on the wealthiest Americans according to The New York Times at a 20 tax rate a family with a 10 billion fortune that appreciates to 11 billion will have to. President Biden and Secretary Yellen are committed to taxing wealth like work and the Office of Tax Policy has been busy developing plans centered around that goal.

A 2 drawdawn on your unrealized capital gains requires people to have set aside cash for that very tax purpose.

Us Lawmakers Float Tax On Billionaires Unrealised Capital Gains The Market Herald

Janet Yellen S Preposterous Tax Plan Stock Investor

An Act Of War Against The Middle Class Americans Criticize Janet Yellen S Idea To Tax Unrealized Capital Gains R Cryptocurrency

Why The Fed Needs Janet Yellen To Steal W Unrealized Capital Gains Avoiding Taxes W Roth Iras Youtube

Tax On Unrealized Capital Gains Proposal By Janet Yellen Exponential Age Youtube

Janet Yellen Favors Higher Company Tax Signals Capital Gains Worth A Look Business Standard News

Janet Yellen Just Proposed A Tax On Unrealized Capital Gains For Those Who Don T Know

Tax On Unrealized Gains How Long Before It Hits Every Investor By Rick Mulvey Medium

Breaking Treasury Secretary Yellen Is Calling For An Unrealized Gains Tax This Is Unconscionable For Those

Democrats Terrible Idea Taxing Profits That Don T Exist

Lesson Of The Day Amy Tarkanian Janet Yellen Just Proposed A Tax On Unrealized Capital Gains

Treasury Secretary Janet Yellen Says Taxing Unrealized Capital Gains Is A Possibility Youtube

Janet Yellen May Give Us Bitcoin Investors Tax Shock Somag News

Janet Yellen S Idea To Tax Unrealized Capital Gains R Wallstreetbets

Yellen Describes How Proposed Billionaire Tax Would Work Including Yellen S Proposed Tax On Unrealized Gains In The Stock And Real Estate Market R Wallstreetbets

Bloombergquint On Twitter Yes Taxation Of Unrealised Stock Market Gains Seems Unusual But It Is Already Embedded In The System Argues Shankkaraiyar Calling For A One Time Tax On Billionaires He Points To

Best Argument Against Unrealized Capital Gains Tax Janet Yellen Capital Gains Tax Youtube

Yellen Argues Capital Gains Hike From April 2021 Not Retroactive

Janet Yellen It S Not A Wealth Tax It S A Tax On Unrealized Capital Gains Bit Haw